Difference Between Gross, Operating and Net Profit with Similarities and Comparison Chart

Content

Your gross profit does not represent how much you have to dip into for your business owner wages or to reinvest in your business. The difference between gross profit and net profit is when you subtract expenses. Understand gross profit vs. net profit to make business decisions, create accurate financial statements, and monitor your financial health. COGS will be used in both gross and net profit formulas, so be sure to keep this number handy once you have it. Use the above formula regularly to keep a finger on your company’s net or gross profits, as COGS will change over time.

Your income statement shows your revenue, followed by your cost of goods sold, and your gross profit. As a startup owner, you likely feel your brain is at capacity when it comes to formulas and financial knowledge. But understanding gross profits and net profits can help you make informed decisions about your business. These decisions can open the door to more opportunities — like attracting investors — and help you take your business to new places.

How Do I Calculate Net Income From Gross?

Review the background of Brex Treasury or its investment professionals on FINRA’s BrokerCheck website. Please visit the Deposit Sweep Program Disclosure Statement for important legal disclosures. Gross profits and net profits may seem similar at a glance, but the two provide very different information that can be used for a number of things. To help you get the most out of your business , let’s take a look at gross and net profits. Net income is arguably the most important financial metric, reflecting a company’s ability to generate profit for owners and shareholders alike. Since net income is the last line located at the bottom of the income statement, it’s also referred to as the bottom line.

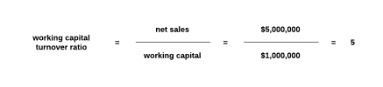

How do you calculate gross and net profit?

Gross profit is calculated by subtracting cost of goods sold from net revenue. Then, by subtracting remaining operating expenses of the company, you arrive at net income.

Gross profit is the direct profit left after subtracting the cost of goods sold from revenue. Here is a comparison chart of gross profit and net profit to highlight the Gross Profit Vs Net Profit key differences between the two. The total selling and administrative expense are $14,804,000 after adding the demand creation expense and operating overhead expense.

What Is Meant by a Product’s Contribution Margin?

To check how you’re doing in a percentage value, you need to do another quick calculation and divide your gross margin amount by total revenue, then times by 100. When you calculate gross profit margin at regular intervals and look at your numbers over time, it gives you an indication of how well your processes and systems are working. If your margin percentages https://kelleysbookkeeping.com/ remain stable, it’s a sign that your business is in good health. Gross profit ratio is one metric that provides key insights as to the profitability of your specific products or services. Also called gross profit margin, gross profit ratio is the percentage of gross sales of a particular product or service that is profit above the cost of producing that good.