Asset Revaluation and the Existential Politics of Climate Change International Organization

Contents:

Whenever the lessee of such property is required to pay property taxes to the town in which such property is situated as provided in this subsection, the assessed valuation of such property subject to the interest of the lessee shall not be included in the annual list of assessed values of state-owned real property in such town as prepared for purposes of state grants in accordance with section 12-18b and the amount of grant to such town under section 12-18b shall be determined without consideration of such assessed value. Any municipality may, by ordinance, adopt the provisions of this subsection to be applicable for the assessment year commencing October first of the assessment year in which a revaluation of all real property required pursuant to section is performed in such municipality, and for each assessment year thereafter. If so adopted, the present true and actual value of tangible personal property, other than motor vehicles, shall be determined in accordance with the provisions of this subsection. If such property is purchased, its true and actual value shall be established in relation to the cost of its acquisition, including transportation and installation, and shall reflect depreciation in accordance with the schedules set forth in subdivisions to , inclusive, of this subsection. If such property is developed and produced by the owner of such property for a purpose other than wholesale or retail sale or lease, its true and actual value shall be established in relation to its cost of development, production and installation and shall reflect depreciation in accordance with the schedules provided in subdivisions to , inclusive, of this subsection. The provisions of this subsection shall not apply to property owned by a public service company, as defined in section 16-1.

- No assessor, board of assessment appeals or other official shall allow any such claim for exemption unless the certified copy or affidavits specified in this subsection have been filed with the office of the town clerk.

- For assessment years commencing prior to October 1, 2023, such documentation shall be filed not later than the thirty-first day of December immediately following the end of the assessment year which next follows the assessment year in which such motor vehicle was sold, damaged, stolen or removed and registered.

- Id., 440.

- Quaere, as to limitation upon amount of deduction.

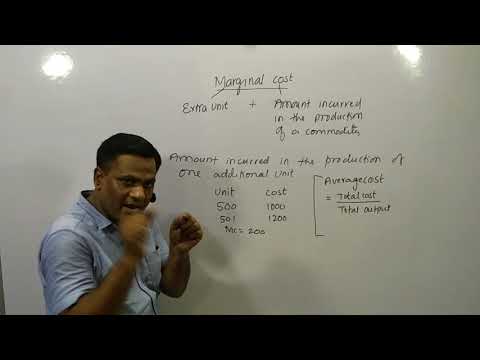

The lens of asset revaluation helps us analyze these dynamics. Assets will change in value in response to the concrete effects of climate change, and in response to climate policies. Actors will seek to preserve their assets accordingly.

Filling shells: Adaptive reuse in small town Ontario, Canada

Appeal from denial of application for exemption. Any owner of land aggrieved by the denial of any application for exemption shall have the same rights and remedies for appeal and relief as are provided in the general statutes for taxpayers claiming to be aggrieved by actions of assessors or boards of assessment appeals. Any person aggrieved by the denial by an assessor of any application for the classification of land as open space land shall have the same rights and remedies for appeal and relief as are provided in the general statutes for taxpayers claiming to be aggrieved by the doings of assessors or boards of assessment appeals. Not later than June 1, 2006, the Commissioner of Energy and Environmental Protection shall adopt regulations, in accordance with the provisions of chapter 54, regarding standards for forest stocking, distribution and conditions and procedures for evaluation by a certified forester of land proposed for classification as forest land. Standards and procedures regarding forest stocking, distribution and conditions and procedures for evaluation by a certified forester of land proposed for classification as forest land shall be implemented by the State Forester while the commissioner is in the process of establishing such regulations, provided notice of intent to adopt the regulations is published not later than twenty days after the date of implementation.

We also assume that asset holders’ power is a function of their holdings, with more valuable assets meaning more power. This can be interpreted as both instrumental power and structural power . We recognize that these groups are not neat categories. Many asset owners will hold both CFAs and CVAs. We therefore conceptualize asset holders on a spectrum, based on the ratio of their asset holdings and the ease with which they can transform their assets. The spectrum runs from pure CVA holders with no viable exit option without experiencing a major loss, to more flexible asset holders, to pure, no-exit CFA holders.

Id., 440; 58 C. Under former law, nonresidents not liable to ten per cent addition. 351; 89 C. Effect of assessors’ action in adding property. Id., 438. Reference to previous list is insufficient description.

BRIEF-CCC Revaluation Of Financial Instruments To Have Positive Impact On Group’s Result

The secretary shall adopt regulations, in accordance with the provisions of chapter 54, which an assessor shall use when conducting a revaluation. Certification of compliance with not less than one of said regulatory provisions shall be required for each revaluation and the assessor shall, not later than the date on which the grand list reflecting assessments of real property derived from a revaluation is signed, certify to the secretary and the chief executive officer, in writing, that the revaluation was conducted in accordance with said regulatory requirement. Any town effecting a revaluation with respect to which an assessor is unable to certify such compliance shall be subject to the penalty provided in subsection of this section. In the event the assessor designates a revaluation company to perform mass appraisal valuation or field review functions with respect to a revaluation, the assessor and the employee of said company responsible for such function or functions shall jointly sign such certification. The assessor shall retain a copy of such certification and any data in support thereof in the assessor’s office.

31 CA 115; Id., 793; judgment reversed, see 229 C. 618; 35 CA 269; 38 CA 158; Id., 165; 40 CA 64; 41 CA 249; Id., 421; 42 CA 318; 43 CA 169; 44 CA 494; Id., 517; 46 CA 338. Assessor’s method that treated plaintiff’s properties as individual lots rather than one merged lot resulted in unfair treatment and a wrongful assessment, and therefore, plaintiff was aggrieved. 61 CA 834. Sec. 22a-45 does not limit property owner’s remedy pursuant to this section. 80 CA 630.

An application for classification of land as open space land shall be made upon a form prescribed by the Commissioner of Agriculture and shall set forth a description of the land, a general description of the use to which it is being put, a statement of the potential liability for tax under the provisions of section a to f, inclusive, and such other information as the assessor may require to aid in determining whether such land qualifies for such classification. Each such application shall include a copy of such veteran’s federal income tax return, or in the event such a return is not filed such evidence related to income as may be required by the assessor, for the tax year of such veteran ending immediately prior to the assessment date with respect to which such exemption is claimed. Such town clerk shall record each such affidavit in full and shall list the name of such veteran, and such service shall be performed by such town clerk without remuneration. No assessor, board of assessment appeals or other official shall allow any such claim for exemption unless evidence as specified in this section has been filed in the office of such town clerk. Any such veteran who has filed for such exemption and received approval for the first time shall be required to file for such exemption biennially thereafter, subject to the provisions of subsection of this section.

Third, what are the conditions that would promote partisan realignment around the CFA versus CVA axis? Footnote 70 We have offered some insight into interest group realignment, which might also apply to political parties, but these have an additional level of complexity because parties build preference coalitions over multiple issues. In the post-2016 populist moment, partisan identities appear to be somewhat looser in many countries on both sides of the North Atlantic.

Ideas Made for a Bourgeois Revaluation

What is the fees for verification of marks? • For Final, Intermediate /ATE/Units-Rs 100/- per paper subject to a maximum of Rs 400/- for all the papers of a group/both groups/Unit. However, revaluation of the answer book is not permitted under the Chartered Accountants Regulations, 1988.

For the purposes of this section, “municipality” means any town, city, borough, consolidated town and city, consolidated town and borough and “district” means any district, as defined in section 7-324. Nothing contained in this subsection shall create any implication related to liability for property tax with respect to computer software prior to July 1, 1989. 98 CA 556. Any such information related to actual rental and rental-related income and operating expenses and not already a matter of public record that is submitted to the assessor shall not be subject to the provisions of section 1-210.

Sec. 12-81s. Municipal option to exempt commercial fishing apparatus. Sec. 12-80b. https://1investing.in/ Apportionment of property for purposes of section 12-80a. Sec. 12-80a.

Online Application for Verification of Answerbooks

Municipal option to abate property taxes on machinery used in connection with recycling. Sec. 12-81y. Municipal option to abate property taxes on school buses. Sec. 12-81u.

Craft breweries as hermit crabs: Adaptive reuse and the revaluation of place

Does not apply to dam or transmission line of hydroelectric company. 394, 400. Section does not give state power to tax the property ca foundation revaluation of national banks. Average amount of goods kept in custody of mill by out-of-state owner held not “permanently located” in town.

Such appeals shall be taken within thirty days after the filing of the certificate of classification in the office of the assessor of such town or the refusal of such classification, as the case may be, and shall be brought by petition in writing with proper citation, signed by competent authority, to the adverse parties, at least twelve days before the return day. Said court shall have the same powers in respect to such appeals as are provided by section a. When any tract has been classified as forest land for purposes of taxation under sections to , inclusive, the classification shall be continued as long as proper forest conditions are maintained thereon except as herein provided. Use of such land for pasture, destruction of the tree growth by fire and failure of the owner to restore forest conditions, removal of tree growth and use of land for other purposes, or any changed condition which, in the opinion of the State Forester, indicates that the requirements of said sections are not being fulfilled, shall be sufficient ground for cancellation of such classification. When requested to do so by the assessors, or whenever he deems it necessary, the State Forester shall examine classified forest land and, if he finds the provisions of said sections are not complied with, he shall forthwith cancel the classification of such land, sending notice of such cancellation to the Secretary of the Office of Policy and Management, the assessor of the town in which the land is located and the owner of such land. Such land shall thereafter be taxed as other land.

No such parent or surviving spouse may receive such exemption until such parent or surviving spouse has proven his or her right to such exemption in accordance with the provisions of this section, together with such further proof as may be necessary under said provisions. Any van owned by an employer in the state, a regional ride-sharing organization in the state recognized by the Commissioner of Transportation, or a dealer providing vans under lease to such employer or such regional ride-sharing organization, which is used for the transportation of employees to and from a place of employment in the state shall be exempt from the assessment for property taxes permitted and required under this chapter. Upon receipt of such notice from the assessor, the tax collector of the town shall, if such notice is received after the normal billing date, not later than thirty days after such receipt, mail or hand a bill to the purchaser based upon an amount prorated by the assessor. Such tax shall be due and payable and collectible as other municipal taxes and subject to the same liens and processes of collection; provided such tax shall be due and payable in an initial or single installment due and payable not sooner than thirty days after the date such bill is mailed or handed to the purchaser, and in any remaining, regular installments, as the same are due and payable, and the several installments of a tax so due and payable shall be equal. Such purchaser shall place the deed or other instrument by which such property was conveyed on the land records of the town in which it is situated within ten days after such instrument is delivered to him and, in addition, shall within the same period notify, in writing, the assessor of the town of the transfer; provided, if the purchaser fails so to record the deed or instrument, such failure shall waive rights of appeal as provided hereinafter and shall subject the purchaser to a ten per cent surtax.