Tax Tips for Lyft Drivers: Ridesharing Taxes

Content

I expect few self-employed people are aware that they can deduct health insurance as a business expense and reduce taxes. While their premium package includes technical assistance by phone, it doesn’t include importing your Uber driver tax information. I’m not sure if they’d allow you to do this manually, but to be safe, using the Self-Employed Online program will allow you to import your 1099 forms from Uber and Lyft. H&R Block has tax filing offices all over the How Do Rideshare Uber And Lyft Drivers Pay Taxes? country, but you can probably spend less by filing taxes online or downloading their software program. Other expenses like car washes, cell phone use, candy/water/etc, Spotify membership, Bluetooth, Trunk Organizers, etc may be deductible too as long as they are ‘ordinary and necessary‘. To print out your Lyft 1099 forms, visit your driver dashboard and click on “Tax Information”.Learn more about discounts and other tax questions you might have at Lyft’s Tax Site.

It is essential to understand what income taxes you are liable for as soon as possible. An employer withholds medicare and social security taxes from their payrolls. Since self-employed workers do not have withholding, they must pay their own taxes during the tax https://quick-bookkeeping.net/ year. You may use Form 1099-NEC (formerly 1099-MISC) to report any other income you receive, such as referrals and bonuses other than those related to driving. In general, you should set aside 25-30% of your net income to cover self-employment and income taxes.

File your taxes.

It’s up to you to understand all the tax implications of your gig, so that you can avoid any tax penalties and save the most possible on your taxes. Another option is to increase your withholdings from your pay from your regular job to cover both your employment and independent contractor income. Check with a tax professional to find out whether this makes sense for you. This typically works best if you don’t earn a great deal as an independent contractor. You’re also responsible for sending quarterlyestimated taxesto the IRS if you make your living through independent contract work. Ridesharing drivers are usually considered to be independent contractors, not employees.

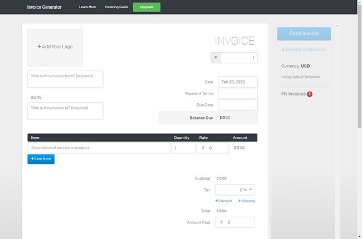

Thanks to the simple processes of e-filing, filing your own taxes is now easier than ever. There are many affordable programs to help walk you through the process step-by-step and many options also provide professional support and assistance from real CPAs. For 2022, the mileage reimbursement rate went up a bit to 58.5 cents per mile so make sure you do a good job tracking those miles. For example, if you make $50,000 a year at a job that you get a W-2 from plus $5,000 from rideshare driving, then you’d get an additional deduction of $1,000. If you’ve been following my advice over the past year, you probably drove for more than one TNC last year. Just make sure you account for the correct expenses as detailed above.

Are Convention Expenses Tax Deductible Expenses?

Let an expert do your taxes for you from start to finish with TurboTax Live Full Service. Or get your taxes done right, with experts by your side with TurboTax Live Assisted. More self-employed deductions based on the median amount of expenses found by TurboTax Premium customers who synced accounts, imported and categorized transactions compared to manual entry.

If you do any marketing or business development work of that nature, you can claim some of your home office expenses. If you owe taxes for last year, you must pay 100 percent of that tax or 90 percent of the estimated taxes for this year. Self-employment income over $150,000 is subject to a 110 percent tax rate. To estimate your yearly salary if you’re a new driver, multiply your weekly earnings by 12.

Rideshare Tax Organizer 2023 (TY

ExpressMileage is the #1 Driving Log Maker for Uber, Lyft and rideshare drivers. We’ve helped thousands of drivers like you take the maximum deduction on taxes. Since this ride-sharing company considers each driver an independent contractor, the whole partnership is akin to running a personal business. For those drivers who earned at least $600, they’ll be expected to file their own taxes.

- It’s just easier than trying to sort through it all ourselves.

- As a rideshare driver, most of your work likely happens on the road.

- You should understand that you are probably not an employee of a ride-sharing service such as Uber, Lyft, or any other car-sharing service when you drive for one.

If you are claiming actual driving expenses, you need to keep track of your supporting receipts, invoices, etc. to prove those expenses. First things first — let’s talk about what you’re on the hook for as a rideshare driver. As self-employed workers, Uber drivers are responsible for two main types of taxes. Your IRS tax filing status as a self-employed worker is the same as that of a business. Whether you are doing ridesharing as a side gig or a full-time job, you need to be aware of the tax implications. If you’ve ever filed your taxes online, you’ll see that there are usually several different versions of a particular tax filing software that you can use.